Thomas Cook (India) Limited and its Group Company SOTC Travel have unveiled the fourth edition of their India Holiday Report, a comprehensive study offering insights into the evolving travel aspirations and behaviors of Indian consumers. The report, based on a month-long survey of over 2,500 respondents (including past customers and non-customers), highlights a significant shift in travel patterns driven by increasing disposable incomes and a growing desire for experiential holidays.

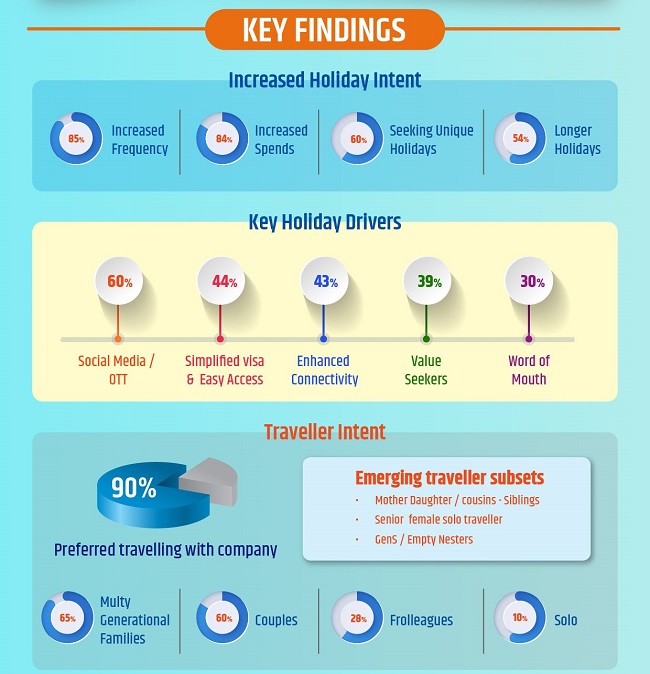

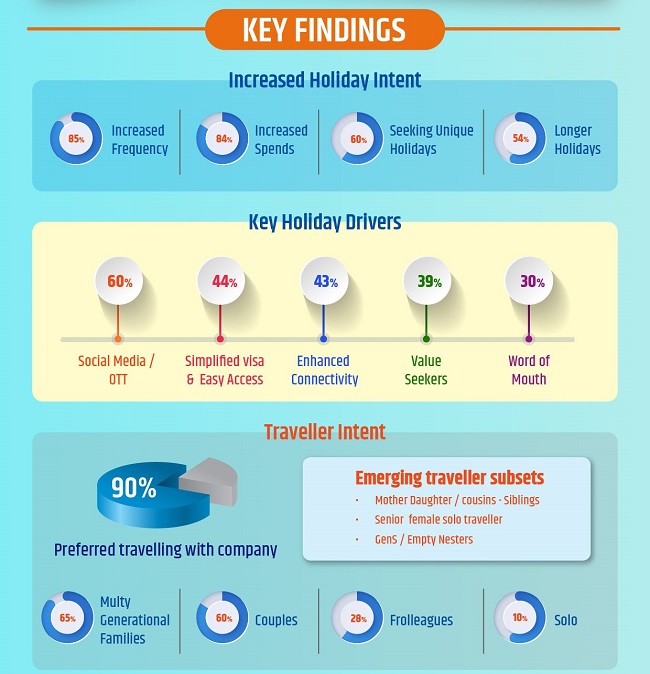

The findings paint a picture of a flourishing travel economy, with 85% of Indians planning to increase their holiday frequency in 2025 and a substantial 84% intending to boost their travel budgets by 20% to 50%. A notable trend indicates that 60% of travelers are seeking unique, experiential, or “bucket-list” holidays, and 54% are opting for longer vacations, extending trips by an additional 5-10 days.

Experiential and event-led travel is at the forefront of Indian preferences, including polar/icebreaker cruises, music concerts, global sporting events, wildlife safaris, gastronomy and vineyard trails, stargazing camps, and phenomenon travel (such as Northern Lights, Cherry Blossom, and Midnight Sun). The report also notes the continued influence of “phygital” journeys—blending digital discovery with human touchpoints—in driving bookings. Furthermore, travelers are showing a clear inclination towards longer domestic and international holidays, with new-age Indian travelers also keen on spiritual journeys, exploring hidden gems, and distinctive accommodations like igloos, treehouses, chalets, and chateaux.

Key Findings from the India Holiday Report 2025:

1. Key Holiday Drivers: Travel has become an essential part of the Indian lifestyle, influenced by several factors: * Media Influence: 60% of respondents indicated that social media, OTT platforms, and movies increasingly shape their travel decisions. * Simplified Visa Processes: 44% are more likely to visit countries offering simplified visa processes (e.g., e-visa or visa-on-arrival) like Thailand, Malaysia, UAE, and Sri Lanka, while countries with long-term visas such as Australia, Japan, and the USA are also gaining traction. * Enhanced Connectivity: 43% reported that new routes and direct flights are significantly improving accessibility, boosting demand from metros and rapidly growing Tier 1 and 2 regional markets. * Value-Seeking Consumers: 39% actively seek promotions, highlighting the strong influence of discounts and special offers on purchasing decisions. Promotional campaigns from tour operators and tourism boards are driving interest, while a clear shift towards trusted travel brands for premium experiences reflects a focus on reliability. * Word of Mouth: 30% of respondents confirmed that recommendations from friends, family, and colleagues continue to impact their holiday choices.

2. Increased Frequency and Longer Stays: * More Holidays: 85% of respondents plan to increase their holidays from an average of two trips per year to four to six annually. * Mini-cations: 47% intend to leverage long weekends and public holidays for short getaways. * Extended Trips: 54% prefer longer holidays, extending their trips by 5-10 days to create vacations averaging 8-15 days.

3. Strong Holiday Spending Intent: * Budget Increase: Approximately 84% of respondents plan to increase their travel spends by 20-50% in 2025, with over 18% intending to boost budgets by a significant 50%. * This trend reflects a broader allocation of budgets towards gastronomy, unique experiences, and shopping, including at premium outlets like McArthurGlen and Bicester Village.

4. Evolving Travel Companion Preferences: * Group Travel Dominates: 90% prefer traveling with company. Multigenerational families lead at 65%, followed by couples (60%) and a rising segment of “frolleagues” (colleagues who are also friends) at 28%. Solo travel accounts for 10%. * Family Bonding: There’s an increase in family-focused trips, such as mother-daughter getaways and sibling/cousin holidays. * Growing subsets include solo female travelers (even in older age groups) and empty nesters, reflecting diverse companion preferences across demographics.

5. Experiential Travel Takes Center Stage: * Experience-Led Holidays: Close to 75% of respondents expressed strong interest in experience-led holidays. * Phenomenon-Based Travel: Over 45% prioritize phenomenon-based travel (e.g., Northern Lights in Norway/Murmansk, Cherry Blossoms in Japan/South Korea, Midnight Sun in Iceland/Russia), signaling a pivot towards bucket-list experiences. * Adventure and Gastronomy: Uptick in safaris, self-drives, and outdoor adventures (32%), along with gastronomy tours (26%) in destinations like France, Spain, Australia, Thailand, Malaysia, Japan, and South Korea. * Event Tourism: Global music concerts, sporting events, and festivals are also on the rise (22%), particularly in Australia, Abu Dhabi, and Thailand. * Spa-Wellness: Relaxation and rejuvenation trips are gaining demand (19%), especially in destinations like Thailand, Bali, and Kerala.

6. Rise of Premium & Luxury Holidays: * Over 36% of respondents are opting for premium experiences such as transportation via supercars/bikes, luxury cruise holidays (Scandinavia, Mediterranean, USA), private island dining in Australia, and upscale stays in boutique hotels, French chateaux/Swiss chalets, and heritage properties in India.

7. Destination Preferences: * International: Europe remains a top choice (50%), led by Switzerland, France, Austria, and Germany, with Eastern European countries like Czech Republic, Hungary, and Croatia emerging. Short-haul destinations like Southeast Asia (Thailand, Malaysia, Indonesia, Singapore) follow at 46%, along with Dubai, Abu Dhabi, Oman, and Ras Al-Khaimah (37%), Japan & South Korea (35%), and Australia-New Zealand (26%). Island locales such as Mauritius, Maldives, Bali, and Sri Lanka (22%), and South Africa & Kenya (12%) are also popular. Central Asia (Uzbekistan, Kyrgyzstan, Kazakhstan) shows growing interest (32%) due to easy access and affordability, while Morocco, Iceland, and Greenland (8%) are appearing on the radar. * Domestic & Subcontinent: Kashmir, Himachal Pradesh, and Uttarakhand (55%) remain top favorites. Northeast India (25%), Bhutan (32%), Rajasthan & Kerala (21%) are also popular. Island/beach escapes like Andaman & Lakshadweep (3%) are gaining momentum, alongside Goa (13%).

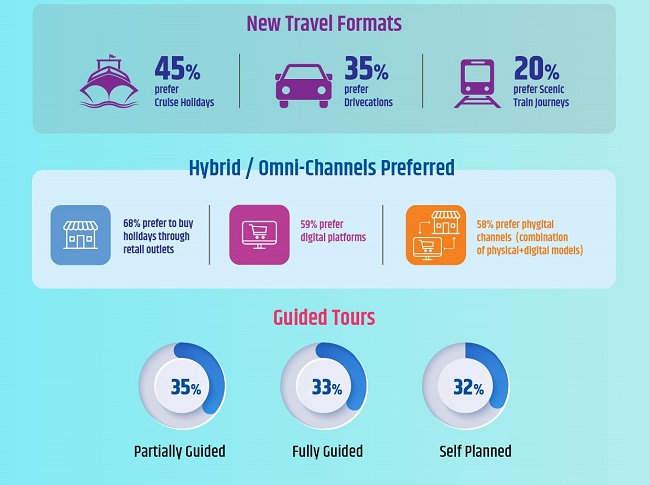

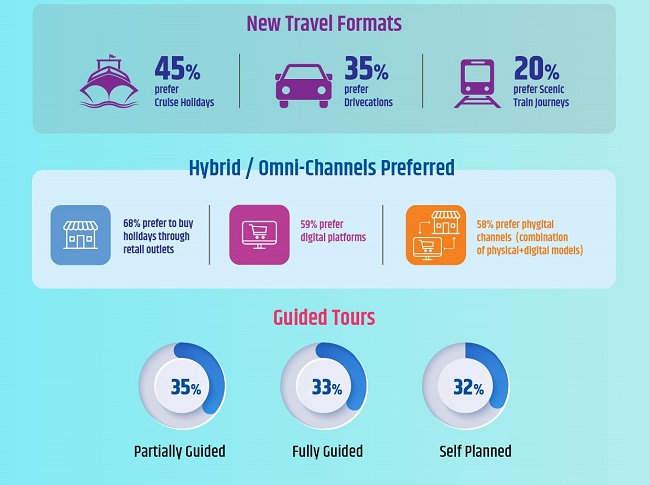

8. Increasing Demand for New Travel Formats: Indians are increasingly opting for unique travel formats beyond traditional flights: * Cruises (45%), self-drives (35%), and scenic train journeys (20%) are now among the top three preferred holiday formats, as travelers seek unique, curated, and comfort-first experiences. This shift reflects a growing appeal for slow, immersive travel, including sustainable options like scenic train journeys in Switzerland.

9. Booking Patterns: Travelers are increasingly using a blend of digital platforms for research, with contact centers and retail outlets for bookings, making “phygital” journeys a key driver of conversions. * Phygital Preference: 58% prefer a mix of online convenience with offline guidance, while 59% opt for in-person visits to tour agencies or phone conversations, and 68% book online. * Despite growing digital adoption, a strong dependency on in-person agency visits remains due to the value placed on human touch, personalized guidance, and expert recommendations.

10. Diverse Travel Styles: The report reveals a near-equal distribution in traveler preferences for holiday types: * Partially Guided Tours: 35% prefer partially guided tours, valuing a balance of structure and autonomy. * Fully Packaged Tours: 33% opted for fully packaged and guided tours, seeking a seamless, worry-free experience. * Self-Planned Journeys: An equal number of respondents (32%) opted for entirely self-planned journeys.

11. Sustainability Focus: 37% of respondents are increasingly prioritizing sustainability and eco-conscious practices in their travel choices.

12. Impact of AI & Tech on Travel Planning: The rise of AI and technology is transforming travel planning, with 35% of travelers using digital platforms for research, bookings, and itinerary planning.

Rajeev Kale, President & Country Head – Holidays, MICE, Visa, Thomas Cook (India) Ltd., commented, “The Indian traveler story is no longer just about destinations—it’s a reflection of evolving lifestyles and rising aspirations. Our Holiday Report 2025 clearly signals the emergence of a bold, experience-first traveler mindset. Indians are not only traveling more but also increasing spends, choosing depth, discovery, and emotion over traditional sightseeing tours. While multigenerational family segments continue to lead, we are seeing a strong emergence of new travel subsets like ‘frolleagues’ and solo travelers.”

Kale added, “Our Holiday Report 25 reflects a strong shift towards offbeat travel and emerging destinations like phenomenon travel—whether it’s experiencing cherry blossoms in Japan/South Korea or witnessing the midnight sun in Scandinavia/Russia. At Thomas Cook, we’re excited to witness the rapid evolution of Indian travelers and are curating exciting holidays that reflect this experience-first outlook.”

SD Nandakumar, President & Country Head – Holidays & Corporate Tours – SOTC Travel, stated, “Our Holiday Report 2025 reflects evolving travel formats, with Indians moving away from rushed itineraries in favor of comfort-first, immersive experiences. Slow travel is seeing an uptick, with river and ocean cruises and sustainable rail journeys offering unique opportunities for exploration. Additionally, spiritual/pilgrimage tourism is on the rise—with our ‘darshans’ portfolio coupled with adventure tourism gaining popularity, interestingly from young India’s millennials and GenZ.”

Nandakumar concluded, “Booking behaviors have also shifted—while Indians are researching online, they continue to value expert guidance, making SOTC’s phygital approach a key driver of trust and convenience. At SOTC, we’re proud to offer experiences to suit every Indian traveler segment. With over 75 years of experience and a deep understanding of Indian travelers’ evolving needs, SOTC ensures that every journey is memorable and enriching.”

The Thomas Cook India and SOTC Travel India Holiday Report 2025 underscores the companies’ commitment to understanding evolving traveler preferences and tailoring their offerings accordingly. The consistent trend from 2023 to 2025 is clear: India is traveling more, spending more, and expecting more from every holiday.