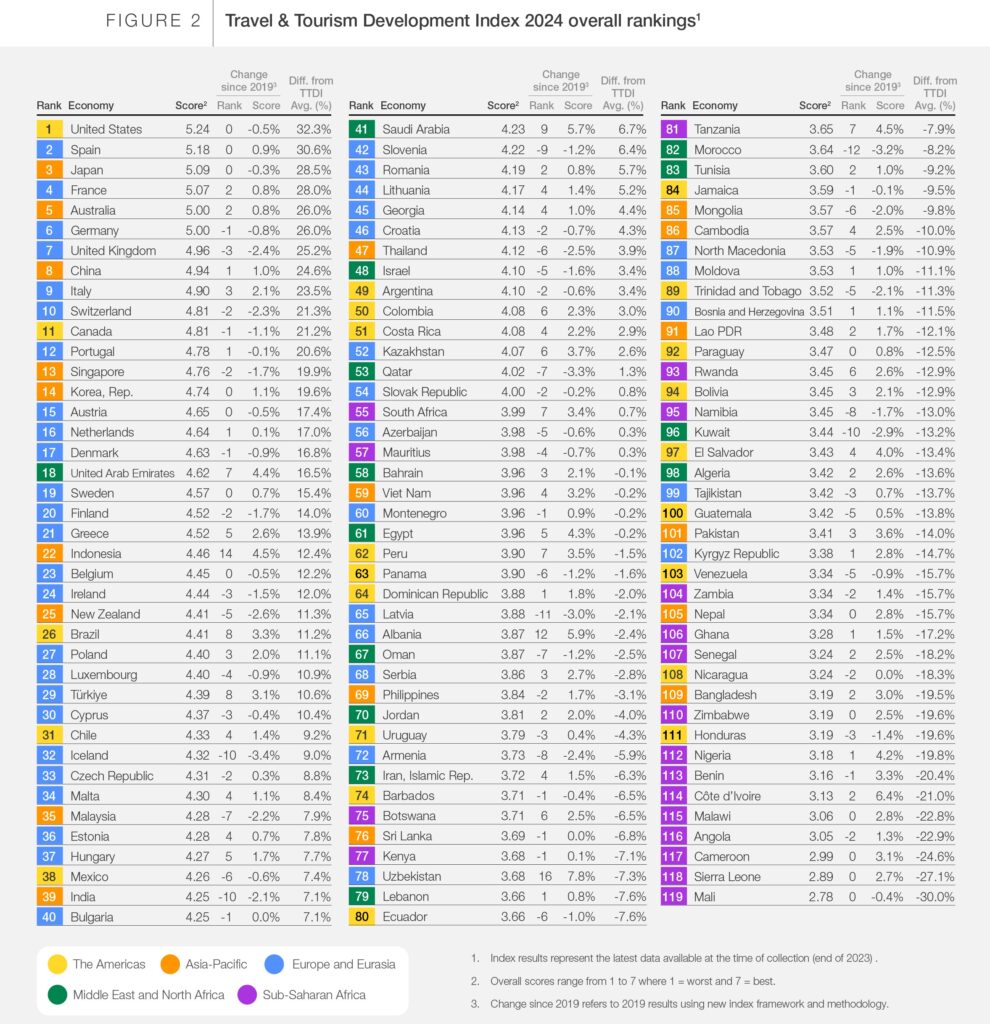

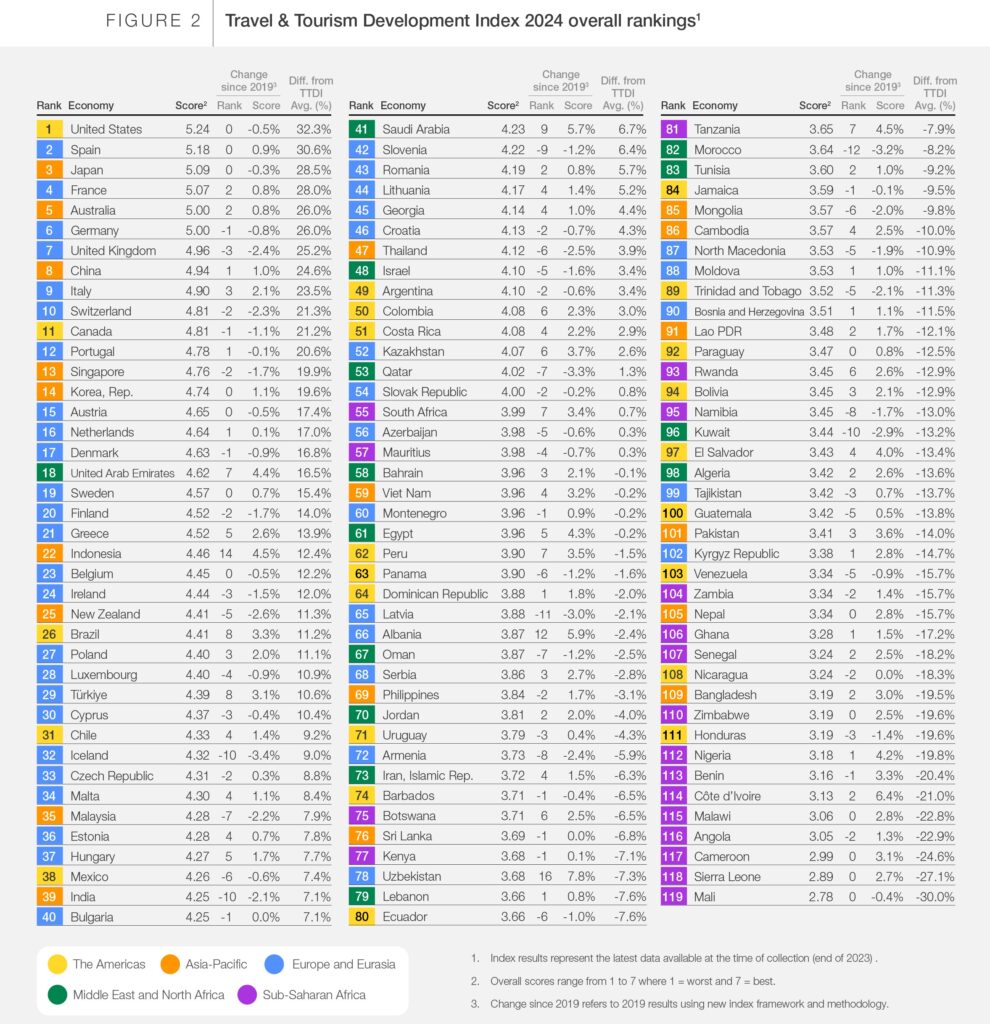

India climbed 15 positions, improving its rank to 39 this year from 54th in 2021. China moved up 4 positions, reaching 8th from 12th in 2021. However, Japan lost its top position to the USA, dropping to 3rd place behind Spain. The UAE improved its rank from 25th to 18th in 2024. Malaysia moved up 3 positions, while Thailand fell from 36th in 2021 to 47th in 2024. Singapore also dropped, moving from 9th to 13th place, and Sri Lanka slipped to 76th from 74th in 2021.

International tourist arrivals and the travel and tourism sector’s contribution to global GDP are expected to return to pre-pandemic levels this year, driven by the lifting of COVID-19-related travel restrictions and strong pent-up demand, according to a new World Economic Forum travel and tourism study.

Despite significant post-pandemic growth, the global tourism sector still faces complex challenges. Recovery varies by region, with only marginal overall score improvements since the 2021 edition. Developing economies are making notable strides—52 out of 71 have improved since 2019—but substantial investment is needed to bridge gaps and increase market share.

High-income economies in Europe and Asia-Pacific continue to dominate the World Economic Forum Travel and Tourism Index, with the United States, Spain, and Japan maintaining top rankings.

Leading the 2024 list of economies are the United States, Spain, Japan, France, and Australia. The Middle East achieved the highest recovery rates in international tourist arrivals (20% above the 2019 level), while Europe, Africa, and the Americas all showed strong recoveries of around 90% in 2023.

These findings are part of the Travel & Tourism Development Index 2024 (TTDI), a biennial report published in collaboration with the University of Surrey. The report analyzes the travel and tourism sectors of 119 countries, evaluating a range of factors and policies.

“This year marks a turning point for the travel and tourism sector, which we know can unlock growth and serve communities through economic and social transformation,” said Francisco Betti, Head of the Global Industries team at the World Economic Forum. “The TTDI provides a forward-looking view into the current and future state of travel and tourism, helping leaders navigate the latest trends and sustainably unlock the sector’s potential for communities and countries worldwide.”

Post-Pandemic Recovery

The global tourism industry is set to recover and surpass pre-pandemic levels, driven by a surge in demand, increased flights, greater international openness, and heightened investment in natural and cultural attractions. However, the recovery has been mixed. While 71 of the 119 ranked economies have improved their scores since 2019, the average index score is just 0.7% above pre-pandemic levels.

The sector, although rebounding from the pandemic, continues to face challenges such as macroeconomic, geopolitical, and environmental risks, scrutiny over sustainability practices, and the impact of new digital technologies. Additionally, labour shortages, insufficient air route capacity, capital investment, and productivity have not kept pace with increased demand. This imbalance, exacerbated by global inflation, has led to higher prices and service issues.

TTDI 2024 Highlights

Out of the top 30 index scorers in 2024, 26 are high-income economies. Nineteen are in Europe, seven in Asia-Pacific, three in the Americas, and one (the United Arab Emirates) in the Middle East and North Africa (MENA) region. The top 10 countries in 2024 are the United States, Spain, Japan, France, Australia, Germany, the United Kingdom, China, Italy, and Switzerland.

High-income economies generally have more favourable conditions for travel and tourism development, supported by conducive business environments, dynamic labour markets, open travel policies, strong infrastructure, and well-developed natural, cultural, and non-leisure attractions.

Developing countries, however, have shown significant improvements. China remains in the top 10 among upper-middle-income economies, with emerging destinations like Indonesia, Brazil, and Türkiye joining China in the top quartile. Low- to upper-middle-income economies account for over 70% of the countries that have improved their scores since 2019. MENA and sub-Saharan Africa are among the most improved regions. Saudi Arabia and the UAE are the only high-income economies among the top 10 most improved since 2019.

Despite these advances, the TTDI warns that substantial investment is needed to close gaps in enabling conditions and market share between developing and high-income countries. Sustainable use of natural and cultural assets, which are less income-dependent, can offer developing economies opportunities for tourism-led economic development.

“It’s essential to bridge the divide in building a strong environment for the travel and tourism sector to thrive,” said Iis Tussyadiah, Professor at the University of Surrey. “The sector has the potential to foster prosperity and mitigate global risks, but this can only be fully realized through a strategic and inclusive approach.”

Mitigating Future Global Challenges

The World Economic Forum’s 2024 Global Risks Report highlights the sector’s various challenges, including geopolitical uncertainties, economic fluctuations, inflation, and extreme weather. Balancing growth with sustainability remains a significant issue due to high seasonality, overcrowding, and a likely return of pre-pandemic emissions levels. Equity and inclusion concerns persist, particularly regarding gender parity in regions such as MENA and South Asia.

Despite these challenges, the sector can play a vital role in addressing them. Prioritizing actions like leveraging tourism for conservation efforts, investing in inclusive and resilient workforces, managing visitor behaviour and infrastructure strategically, encouraging cultural exchange, and bridging the digital divide can help.

If managed strategically, the travel and tourism sector—which has historically represented 10% of global GDP and employment—can significantly contribute to the well-being and prosperity of communities worldwide.

The 2024 edition of the TTDI includes improvements based on newly available data and recent indicators on the environmental and social impact of travel and tourism. Changes made to the 2024 Index limit its comparability with the TTDI 2021 edition. This year’s report includes recalculated 2019 and 2021 results using new adjustments. TTDI 2024 reflects the latest data available at the end of 2023. The TTDI is part of the Forum’s broader work with industry communities to build a better future through sustainable, inclusive, and resilient industry ecosystems.

Also Read

UN Tourism reports openness is back to pre-pandemic levels

Watch on Youtube